Risk Management

Regulatory Developments

Recent financial crises have demonstrated numerous weaknesses in the global regulatory framework and in banks’ risk-management practices. In response, regulatory authorities have considered various measures to increase the stability of the financial markets and prevent future negative impact on the economy. One major focus is on strengthening global capital and liquidity rules.

Basel III addresses this, with the goal of improving the banking sector’s ability to absorb shocks arising from financial and economic stress. In December 2010, the Basel Committee on Banking Supervision (BCBS) published the Basel III documents “Basel III: A global regulatory framework for more resilient banks and banking systems” (a revised version was published in June 2011) and “Basel III: International framework for liquidity risk measurement, standards and monitoring.” With this reform package, the BCBS aims to improve risk management and governance as well as strengthen banks’ transparency and disclosure. Basel III is also designed to strengthen the resolution of systemically significant cross-border banks.

Key Highlights of Basel III Requirements

CAPITAL

Pillar 1

Minimum capital requirements

Capital

Quality and level of capital

Greater focus on common equity. The minimum will be raised to 4.5% of risk-weighted assets, after deductions.

Capital loss absorption at the point of non-viability

Contractual terms of capital instruments will include a clause that allows — at the discretion of the relevant authority — write-off or conversion to common shares if the bank is judged to be non-viable. This principle increases the contribution of the private sector to resolving future banking crises and thereby reduces moral hazard.

Capital conservation buffer

Comprising common equity of 2.5% of risk-weighted assets, bringing the total common equity standard to 7%. Constraint on a bank’s discretionary distributions will be imposed when banks fall into the buffer range.

Countercyclical buffer

Imposed within a range of 0–2.5% comprising common equity, when authorities judge credit growth is resulting in an unacceptable buildup of systematic risk.

Risk Coverage

Securitisations

Strengthens the capital treatment for certain complex securitisations. Requires banks to conduct more rigorous credit analyses of externally rated securitisation exposures.

Trading book

Significantly higher capital for trading and derivatives activities, as well as complex securitisations held in the trading book. Introduction of a stressed value-at-risk framework to help mitigate procyclicality. A capital charge for incremental risk that estimates the default and migration risks of unsecuritised credit products and takes liquidity into account.

Counterparty credit risk

Substantial strengthening of the counterparty credit risk framework. Includes: more stringent requirements for measuring exposure; capital incentives for banks to use central counterparties for derivatives; and higher capital for inter-financial sector exposures.

Bank exposures to central counterparties (CCPs)

The Committee has proposed that trade exposures to a qualifying CCP will receive a 2% risk weight and default fund exposures to a qualifying CCP will be capitalised according to a risk-based method that consistently and simply estimates risk arising from such default fund.

Containing Leverage

Leverage ratio

A non-risk-based leverage ratio that includes off-balance-sheet exposures will serve as a backstop to the risk-based capital requirement. Also helps contain system-wide buildup of leverage.

Pillar 2

Risk management and supervision

Supplemental Pillar 2 requirements

Address firm-wide governance and risk management; capturing the risk of off-balance-sheet exposures and securitisation activities; managing risk concentrations; providing incentives for banks to better manage risk and returns over the long term; sound compensation practices; valuation practices; stress testing; accounting standards for financial instruments; corporate governance; and supervisory colleges.

Pillar 3

Market discipline

Revised Pillar 3 disclosures requirements

The requirements introduced relate to securitisation exposures and sponsorship of off-balance-sheet vehicles. Enhanced disclosures on the detail of the components of regulatory capital and their reconciliation to the reported accounts will be required, including a comprehensive explanation of how a bank calculates its regulatory capital ratios.

LIQUIDITY

Global liquidity standard and supervisory monitoring

The liquidity coverage ratio

The liquidity coverage ratio (LCR) will require banks to have sufficient high-quality liquid assets to withstand a 30-day stressed funding scenario that is specified by supervisors.

Net stable funding ratio

The net stable funding ratio (NSFR) is a longer-term structural ratio designed to address liquidity mismatches. It covers the entire balance sheet and provides incentives for banks to use stable sources of funding.

Principles for Sound Liquidity Risk Management and Supervision

The Committee’s 2008 guidance Principles for Sound Liquidity Risk Management and Supervision takes account of lessons learned during the crisis and is based on a fundamental review of sound practices for managing liquidity risk in banking organisations.

Supervisory monitoring

The liquidity framework includes a common set of monitoring metrics to assist supervisors in identifying and analysing liquidity risk trends at both the bank and system-wide level.

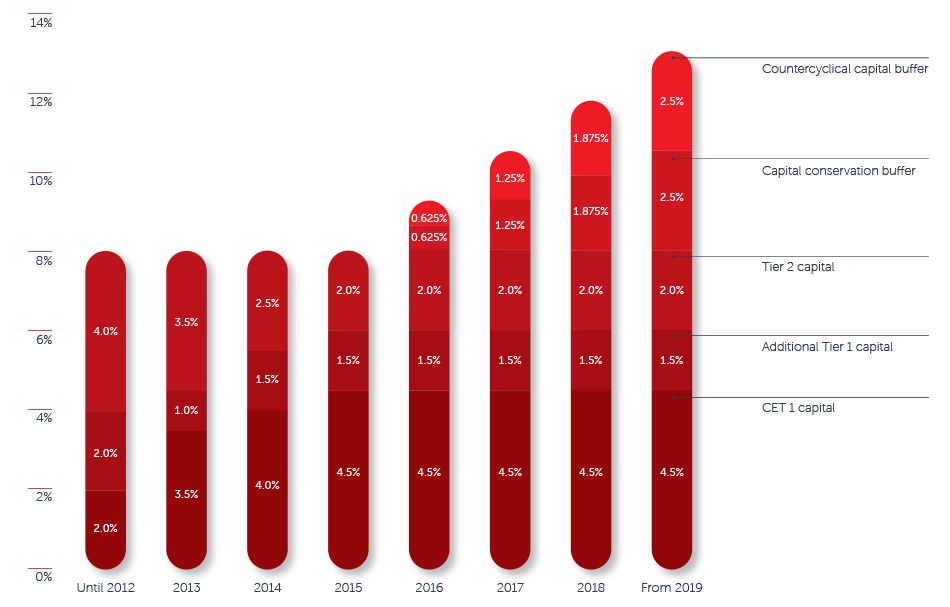

Future Capital Requirements

As the relevant legislation and rules are not yet fully implemented in the UAE, it is not possible to predict the Bank’s final capital requirements. Moreover, actual outcome also depends in part on the future shape of the Bank, future management actions and the future view taken by the Central Bank of the UAE on ADCB’s business and risk profile. Based on our current understanding of the rules, a minimum Common Equity Tier 1 (CET 1) capital requirement can be identified as follows:

- A minimum CET 1 requirement of 4.5% by 1 January 2015

- A capital conservation buffer (CCB) of 2.5% by 1 January 2019

Basel III introduces new or revised treatment of liquidity, leverage, RWA, trading, counterparties, central clearing and other risks that require increased capital. ADCB monitors its compliance relative to international standards and is in a notably comfortable position, being well-capitalised with a conservative approach to balance sheet management. The Bank currently operates at capital levels that are well above the current minimum requirements and, additionally, has a number of levers available to manage future regulatory requirements (e.g. Basel III capital conservation buffer, countercyclical buffer), giving comfort that the Bank will comply with Basel III requirements when they are finally adopted in the UAE. The Bank’s Tier 1 ratio at the end of 2014 was 17.01%.

Basel III Capital Requirements Evolution

Leverage Ratio

The Basel III reforms include the introduction of a leverage ratio framework designed to reinforce risk-based capital requirements with a simple, transparent, non-risk-based ‘backstop’ measure. The leverage ratio is defined as Tier 1 capital divided by the exposure measure. The BCBS will test the proposed 3% minimum requirement for the leverage ratio and has proposed that final calibrations, and any further adjustments to the definition of the leverage ratio, will be completed by 2017, with a view to migrating to a Pillar 1 treatment on 1 January 2018.

Liquidity Coverage Ratio

During the crisis of 2007, many global banks experienced severe funding difficulties despite maintaining adequate capital levels because they did not manage their liquidity in a prudent manner. Consequently, the BCBS developed two minimum standards for funding liquidity. In January 2013, the BCBS published a final standard for the liquidity coverage ratio (LCR) that requires banks to have sufficient high-quality liquid assets to withstand a 30-day stressed funding scenario that is specified by supervisors. It also introduced a net stable funding ratio (NSFR) to address longer-term liquidity mismatches. It covers the entire balance sheet and provides incentives for banks to use stable sources of funding. In January 2014, the BCBS published a proposed revision to the NSFR standards. The minimum NSFR requirement to be introduced in January 2018 is 100%. The methodology for estimating the LCR and NSFR is based on an interpretation of the Basel standards and includes a number of assumptions that are subject to change.

In addition to existing liquidity forecasting tools and management techniques, ADCB monitors its position against anticipated Basel III liquidity metrics — the liquidity coverage ratio and the net stable funding ratio.