Our progress in managing sustainability to date

Our Contribution to UAE Economic Growth

At ADCB, we embrace our role as a catalyst for helping the UAE to prosper. The biggest impact we have is through the businesses we finance. By providing finance efficiently and responsibly, we generate value for our shareholders whilst creating value more broadly for society.

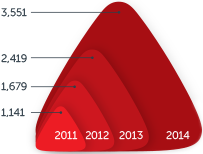

Small and Medium-Size Enterprises (SMEs)

SMEs are an essential component of a successful economy and host the majority of employment opportunities in the UAE. Building SME business is a priority for ADCB. During recent years, our SME business has grown significantly in alignment with our strategic objectives.

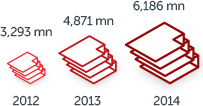

Islamic Finance

The principles of Islamic finance support financial stability and corporate social responsibility, offering mutuality, sustainability, interest in the business of all parties concerned and interest in the success of the end result. This serves to insulate the Islamic financial system from excessive leverage, speculation and uncertainty, which in turn promotes sustainability. ADCB offers focused and differentiated shari’ah-compliant financial solutions to individual and corporate customers through ADCB Islamic Banking and Abu Dhabi Commercial Islamic Finance Company (ADCIF).

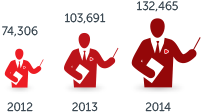

Trade Finance

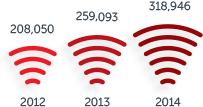

As a leading bank in the UAE, ADCB plays a key role in supporting trade in the region. ADCB’s specialist trade expertise and global reach have enabled our customers to develop and implement tailored solutions across supplier/buyer networks, resulting in significant cost savings and increased resource flexibility. We have shifted to a more efficient and open account-transaction system, allowing savings in costs and time. ADCB’s dedicated Trade Finance team caters to the advisory needs of our customers. Over the last few years, our trade financing activities have increased year over year, which serves as an impetus to the UAE’s economic growth.

How We Do Business Responsibly

Governance

Good governance is key to sustainability. ADCB embraces sound corporate governance practices that enhance shareholder value. In an environment of increased regulatory and reporting requirements, our Board strives to maintain a balance between compliance and the need to deliver sustainable performance to shareholders.

In 2014, ADCB won the Hawkamah Bank Corporate Governance Award for the second time in three years, the highest such accolade in the Middle East and North Africa region. Hawkamah, the Institute for Corporate Governance, recognises banks that have gone the extra mile in improving their corporate governance practices, beyond the legal and regulatory requirements imposed by their respective jurisdictions.

Ethical Banking

ADCB‘s Code of Conduct and robust policies provide a foundation for the stability and sustainable growth of the Bank. Compliance with the ADCB Code of Conduct and applicable regulations is the responsibility of every employee of ADCB. Accordingly, we have instituted processes and policies to ensure enterprise-wide awareness and implementation of control procedures and to prevent any unethical practices, such as money laundering. These include:

- Regulatory Compliance Programme

- Anti-Money Laundering (AML)/Counter Financing Terrorism (CFT)

- Sanctions Compliance

- Conflict of Interest Management (Personal Trading Policy)

- Anti-Bribery Guidelines

- Whistle-Blowing Policy

In 2012, ADCB introduced e-learning modules across the areas of Compliance, AML, Sanctions, Operational Risk, Fraud Prevention and Information Security. In 2014, many of these courses became mandatory yearly requirements for all employees.

Investing in Our Communities

The UAE Vision 2021 and the Abu Dhabi Economic Vision 2030 both emphasise the importance of investing in our communities in order to develop a sustainable UAE economy. ADCB shares this focus and commitment. We contribute to positive social and economic outcomes through strategic partnerships and investments in significant social and environmental causes. We also facilitate the ability of our customers to contribute to beneficial causes through our ATMs and e-platform services. Several of our products and services are designed to specifically address community needs and ambitions (including education loan products and savings accounts for children and UAE nationals). Finally, we voluntarily undertake initiatives designed to improve the wellbeing of our communities.

Financial Contributions

ADCB invests in our communities through direct donations to and sponsorships of multiple organisations that focus on various social, cultural and environmental concerns. In 2014, over AED 16 mn (direct and indirect contributions) in community investments was directed to local organisations, such as the Al Jalila Foundation, Sheikh Zayed Heritage Festival and Ataya. ADCB has also developed strategic partnerships with a number of organisations to support social and environmental causes, including the Khalifa bin Zayed Al Nayhan Foundation, the Al Bait Mutwahid Society, the Emirates Foundation, Red Crescent and the Emirates Wildlife Society-World Wildlife Fund.

Total community contributions

| Total direct community distributions (AED'000) | Indirect community distributions (ATM donations) (AED'000) | Indirect community distributions (Internet donations) (AED'000) | Total contributions (AED'000) | |

|---|---|---|---|---|

| 2012 | 8,768 | 819 | 2,322 | 11,908 |

| 2013 | 9,211 | 764 | 3,495 | 13,470 |

| 2014 | 12,132 | 1,390 | 2,941 | 16,463 |

Breast Cancer Awareness “Pink Month”

Each year, ADCB organises several community events during the month of October — “Pink Month” — to facilitate awareness of and fundraise for breast cancer. In 2014, ADCB partnered with and raised funds for the Al Jalila Foundation through a number of initiatives:

- The ADCB Tree of Hope — This fibreglass tree-shaped structure spreads messages of hope and positivity at breast cancer events. For each AED 10 donation, a member of the public can write their message of hope on a paper leaf, which is then placed on the tree.

- ADCB Zayed Sports City 5K & 10K Pink Run

- ADCB Pink Polo — Pink Polo is a bespoke charity match held at Ghantoot Polo Club in aid of breast cancer awareness, in conjunction with the Abu Dhabi Health Authority.

- ADCB Pink Golf Day — ADCB clients are invited to play golf with ADCB’s senior management and key ADCB breast cancer awareness partners.

- Donate a Dirham Campaign — During Pink Month, ADCB ATM users are given the opportunity to donate AED 1 towards breast cancer awareness at the end of each transaction.

- ADCB Pink Lady Day — This golf event raises funds for Breast Cancer Arabia to help those patients in the UAE who cannot afford treatment.

Promoting UAE Culture

ADCB supports UAE culture through sponsorships and donations, recruitment and professional development practices for UAE nationals, internal Emirati-culture initiatives, and through Islamic banking products and services.

ADCB’s sponsorships in 2014 included:

- Emirates Foundation, which delivers public-private–funded initiatives to improve the welfare of UAE youth

- Sheikh Zayed Heritage Festival, which pays homage to the late Sheikh Zayed bin Sultan Al Nahyan, the founder of the UAE, and honours the rulers of the seven Emirates. Sponsorships in 2014 totalled AED 1,500,000.

- Sheikh Khalifa bin Zayed Al Nayhan Foundation, whose vision is “Pioneering initiatives for Welfare” and whose strategies focus on health and education domestically, regionally and globally.

ADCB proactively attracts and develops UAE national talent through numerous initiatives, including: targeted recruiting through the Washington Career Fair and various local career fairs; active contribution to the Ministry of Presidential Affairs’ “Absher” initiative; the ADCB Emirati Graduate Development Programme; and the ADCB Emirati Academy Programme.

ADCB’s Emirati Committee is dedicated to the development of Emirati nationals through various activities and tools designed to enhance their skills and capabilities, such as training, mentoring, and performing socially responsible activities.

Our Products and Services

ADCB has delivered several products and services to the UAE market that support, promote, recognise and value local needs and cultural traditions. ADCB’s Islamic Banking window provides shari’ah-compliant products and services, such as the Child Saver Account and the Emirati Millionaire Savings Accounts.

Health & Safety

Our subsidiary ADCP commenced an initiative in late 2013, in partnership with the Abu Dhabi Municipality, in order to renovate older buildings under ADCP management. By the end of 2014, ADCP had completed the installation of fall-prevention child-safety devices on approximately 90% of its portfolio across the UAE.

Empowering Our People

At ADCB, we understand that in our business, like any other, the greatest value arises from human capital. The people of ADCB embody our overarching ambition to create the most valuable bank in the UAE through sustainable growth. Our approach to human resources is to select for, develop and inspire excellence and the ability to deliver superior value. We look for high-calibre individuals — people with talent and great ambitions of their own — and provide them with world-class training and support to meet the high expectations of our high-performance culture. Our workplace is a welcoming, diverse and stimulating environment where people with ambition and discipline can thrive.

For a fuller description of our approach to human resources as a responsible employer, including our award-winning efforts to promote Emiratisation and diversity, please see the Business Review in this report.

Human Rights

ADCB closely observes UAE federal laws to ensure that our practices preclude child labour, forced labour and discrimination. This is reinforced through our Code of Conduct as well as systemic remediation mechanisms, including our employee grievance and whistle-blowing processes.

Zero incidents of

human rights

violation in 2014

Managing Our Environmental Impact

As a responsible citizen, ADCB manages our environmental impact by measuring our energy and waste consumption, introducing initiatives to reduce our impact, supporting organisations dedicated to protecting the environment and raising awareness on the importance of safeguarding the environment.

Our Electricity Consumption

Although our impact as a financial services company on energy consumption is not material, we recognise the importance of measuring our impacts in order to more effectively manage them and proactively mitigate climate change.

| 2012 | 2013 | 2014 | |

|---|---|---|---|

| Total electricity consumption (kWh) | 39,477,277 | 38,975,068 | 32,640,246 |

| Impact change | -1.27% | -16.25% |

Waste Management

At ADCB, we reduce and manage our waste through a variety of measures.

- Paper-recycling efforts were expanded in 2014.

- A full waste management programme was introduced at our Abu Dhabi offices in 2014, to recover paper, cardboard, plastics, cans and general waste.

- Paper savings achieved through e-statements were expanded in 2014 to transition corporate clients.

- E-waste recycling is undertaken as required.

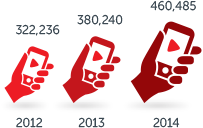

Initiatives to Reduce Our Impacts

During 2014 we continued to install automated sensors in our head office, in order to save energy by switching lights off when the office is vacant. ADCB has also continued to encourage customers to bank through automated channels, such as mobile banking and Internet banking. The mobile banking channel consists of 460,485 subscribers for our SMS banking (launched 2006) and 108,536 subscribers for our smartphone app (launched 2012).

Procurement and Sustainability

ADCB’s environmental impact is affected by the purchasing decisions we make, through the impact of our suppliers and their products and services. Our practice is to support locally sourced products, which reduces distance transportation, safeguards social responsibility and human rights interests, and promotes local economic development. In 2013, our Procurement department introduced sustainability standards into our supplier-selection criteria, as a first step towards encouraging environmental and social responsibility amongst our supply chain. In 2014, the CIPS Middle East Awards recognised ADCB as a finalist for the "Best Contribution to Corporate Responsibility."

Raising Awareness

Since 2012, ADCB has been a Platinum Corporate Sponsor of the Emirates Wildlife Society in association with the World Wildlife Fund (EWS-WWF), a non-profit organisation driving conservation of the natural environment in the UAE. In 2014, ADCB supported EWS-WWF through a number of different actions:

- ADCB participated in "Earth Hour" in unity with others around the world to take action against climate change by turning off the lights at its head office and many branches for one hour.

- We invited our customers to join us and participate in "Earth Hour."

- We sponsored the EWS-WWF Heroes of the UAE Private-Sector Awards ceremony and workshop, which recognised organisations that successfully reduced their carbon emissions by a minimum of 10% over 12 months.

- We invited experts to speak at internal training sessions to raise staff awareness on environmental issues.