Group CEO’s Message

Once again, it gives me great pleasure to report a year of strong performance by your Bank. Simply put, 2014 was a great year for ADCB, a year of record net profit and revenues that built upon a record-setting year before it.

But the story of ADCB is not about one single year, or two strong years in succession, or five years of growth. It is a story about the path we are on and where that path leads.

We seek to become the most valuable bank in the UAE. The only way to accomplish this is through sustainable growth, which is at the root of our strategy.

And our strategy is serving you well.

Leading Indicators

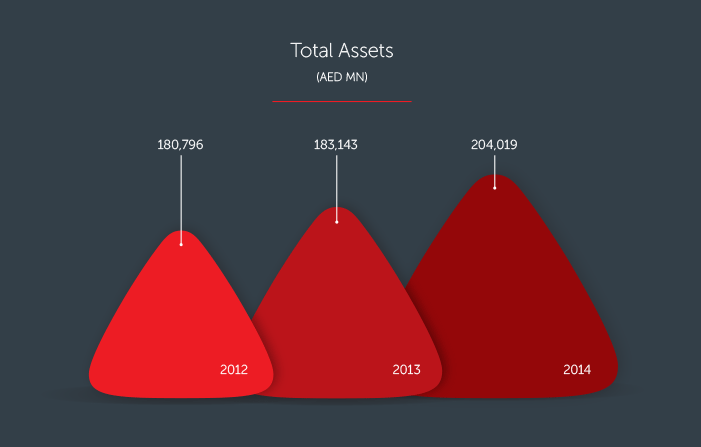

ADCB’s record results in 2014 included crossing the AED 200 bn mark in total assets and the AED 4 bn mark in net profit for the first time. Our operating income of AED 7.5 bn, up 3%, and our net profit of AED 4.2 bn, up 16% from 2013, built on last year’s record numbers. Excluding the one-off gain from retirement of hedges in 2013 and income attributable to non-controlling interests (primarily funds consolidation), net profit attributable to equity shareholders grew by 24%.

We continue to deliver strong results. We are strongly capitalised, with a capital adequacy ratio at an industry-leading level of 21.03%. Even with a significantly high level of capital, our businesses have delivered a strong return on equity of 18.1%, one of the highest amongst our peers. Low-cost current account and savings account (CASA) deposits improved significantly, contributing to 45% of total customer deposits compared to 39% in 2013. Our asset quality continues to improve, and our cost of risk was reported at record low levels.

(AED MN) 204019 Total Assets

(AED MN)

The Right Kind of Growth

Our strategy, resilient by design, sets us apart and keeps us firmly on the path of sustainable growth.

We seek growth with a passion, but only the right kind of growth: the kind that generates sustainable profits. You can see this reflected in our growing, low-cost CASA deposits and operational accounts for both individuals and corporates; our focus on improving customer service for all our customers; our award-winning businesses in cash management and trade finance; and our leading presence in serving small and medium-size enterprises (SMEs). We are attracted to and have fully embraced the granularity of SME and mid-corporate businesses, recognising that big-ticket loans are relatively easy for others to target and therefore subject to ever-diminishing returns. Meanwhile, we are creating mutually beneficial, long-term relationships with a host of business owners who, cumulatively, are an engine of commerce in the growing economy of the UAE.

To strengthen our market-leading and award-winning SME franchise in the UAE, we acquired the SME loan portfolio of Mubadala GE Capital during the early part of the year. This affirms ADCB’s clear strategy to focus on the UAE and to serve this vital sector of the UAE economy.

In our retail business, we have accomplished a remarkable transformation over the years and have become a leader and trendsetter in our markets, including leading in online banking and mobile applications; biometric voice recognition; deep and growing engagement with affluent customers; and a strong and growing Islamic Banking business. To expand our retail presence, in 2014 we launched “SimplyLife,” a basic banking value proposition focused on serving and tapping the potential of the mass-market segment of the UAE.

Our Islamic Banking business remains a prime driver of growth, with Islamic financing assets (gross) up 5% and total Islamic deposits up 15% over 2013.

As you will see in the pages of this report, this intensified focus on sustainable growth has energised all our businesses and helped us to replace a large amount of occasional income with repeatable, recurring income. This is income we can protect and grow.

Committed to the UAE

You will also see that our commitment to the UAE, its economy and its people, runs deep. Our strategy aligns with and supports UAE Vision 2021 and Abu Dhabi Economic Vision 2030, the Government’s pathway from an oil-based economy to a diversified, knowledge-based economy — plans that emphasise developing local talent, supporting local businesses and, above all, sustainable growth. We were humbled to have been selected to represent the banking sector, as an exemplar of efficiency, at the UAE’s 2014 Government Summit. We are also an active participant in and advocate for “Absher,” the Emiratisation initiative launched by His Highness Sheikh Khalifa bin Zayed Al Nahyan to enhance the labour-market participation of UAE citizens.

This commitment inspired our creation of “Tamooha,” a women-only work group designed for Emirati women whose talents and ambitions might otherwise go unexplored. This is the first programme of its kind in our sector or, for that matter, in any sector in the UAE.

We are proud to be the first bank to provide a unique career structure — using flexible hours, home-based options, and a highly digitised, women-only workplace — that enables Emirati women to pursue careers whilst meeting their everyday life responsibilities without compromising their beliefs.

The work is primarily data entry and validation, but also includes a call centre. We have launched a Tamooha Centre in Al Ain, and additional centres are being developed in the Western Region and the Northern Emirates.

I have been very moved by the impact we are having on the lives of these gifted and very productive women. We have given them a place to shine. Our Tamooha women are happy to have a workplace of their own and energised by this opportunity to contribute to their families and to the economy of this ambitious and growing country. And they are committed to the success of ADCB.

Headwinds

2014 did bring challenges and headwinds, some of which persist. The sharp drop in oil prices in the latter part of the year is being felt in the broader economy. The weaker oil price is reflected in weaker headline growth and fiscal and current account positions in the UAE, yet current account is forecast to remain in surplus for 2015.

The underlying economy of the UAE remains strong. The non-oil sector continues to grow at above 5%. The UAE has a strong ability to progress with its investment programme, which will further support private consumption and non-oil exports as population and capacity continue to grow.

Abu Dhabi’s strong fundamentals — low debt, strong foreign exchange reserves, ample liquidity both domestically and internationally — support countercyclical spending. The robust non-oil activity, involving tourism, trade, logistics and the like, further supports wider investments.

Our Journey Continues

At ADCB, we are on a path of moving from good to great. Ambition and discipline will take us there, propelled by the power of our strategy and the passion of our people.

Ours is a story of great continuity and progress. Our management team has remained essentially the same since we launched our strategy five years ago. Our Board has been with us all along the way. Our values are uncompromised, and the value we deliver continues to rise.

We continue to follow a corporate strategy based on measured growth and discipline to deliver sustained profitability and strong operating performance. We have made significant improvement in our cost of funds. Our asset quality shows continued improvement. We are sustaining strong liquidity, and our capital position is at industry-leading levels. As a customer-centric enterprise, we continue to invest in world-class customer service infrastructure and, with the Bank-wide adoption of Net Promoter Score (NPS1) in 2014, we are measuring our progress in customer satisfaction every step of the way.

But we are not satisfied. Our ambition is always to do better. We know that, in everything we do, there will always be room for improvement. And so we press on.

On this journey of ours, we are on the right path and moving in the right direction. We see great things ahead. All of us at ADCB are grateful and honoured to have the continuing support of our shareholders and customers as we move forward, and we invite you to follow our progress along the way.

Ala’a Eraiqat

Group Chief Executive Officer

Member of the Board of Directors

1. NPS is well-recognised as the ultimate measure of customer advocacy. "Net Promoter Score" and "NPS" are trademarks of Satmetrix Systems Inc., Bain & Company, and Fred Reicheld.