Corporate Governance Report

ADCB aspires to high standards of corporate governance. In recent years, the Bank has sought to enhance and improve its corporate governance standards and framework, emphasising transparency, integrity, accountability and fairness.

We believe high standards of corporate governance are a key contributor to the long-term success of a company, creating trust and engagement between the company and its stakeholders. Striving to deliver exemplary governance is a core aspect of the Bank’s strategic intent. We have clear, well-understood governance policies, procedures and practices throughout the Bank. In this Corporate Governance Report, we outline some key aspects of the Bank’s corporate governance framework, including the role and responsibilities of the Board and each of its Committees. We continue to review and develop this framework in light of changes in the Bank’s businesses, best practices and the external environment.

Reporting Principles

As part of the Bank’s commitment to removing ‘clutter’ from its annual report, the Bank reports to the shareholders on corporate governance by publishing: (a) this report, which contains only information that is material and relevant, and which has changed since the most recent annual report; and (b) more detailed information, which is available on the Bank’s website here.

Please visit our website for an overview of the Bank’s governance framework and policies and practices, including the Bank’s Corporate Governance Code, Directors and employees’ Code of Conduct, disclosure standards, communication with shareholders, and investor relations.

The Board

The Board’s Agenda in 2014

The Bank’s Board has adopted a rolling agenda. The rolling agenda ensures that certain big-picture items, including long-term planning, strategy, operational plans, succession planning, performance against budget and strategic targets, and human resources are discussed by the Board on a regular basis. This provides a structural framework for the Board’s oversight.

A Better Way to Govern

External Recognition — Hawkamah Corporate Governance Award

ADCB’s ongoing achievements in corporate governance have resulted in the Bank being recognised as a regional leader in governance, winning several external awards in 2014, including “Best Corporate Governance in UAE” from World Finance magazine and, for the second time in three years, the Hawkamah Bank Corporate Governance Award.

Hawkamah, the Institute for Corporate Governance, promotes corporate-sector reform across the Middle East, North Africa and South Asia, assisting organisations and sectors in developing and implementing sustainable corporate governance strategies. Winners of the Hawkamah Bank Corporate Governance Award are selected following a rigorous interview and judging process, by a panel of independent judges consisting of leading global governance experts.

These awards were recognition of ADCB’s achievements in corporate governance and affirmation of our commitment across all levels of the Bank, from the Chairman, Board Members and executive management to our entire staff. They reaffirm our position as a regional leader in governance, upholding the highest standards of transparency and accountability. In particular, these awards reflect well on our highly effective and engaged Board of Directors, our adherence to best practices in disclosure and transparency, our risk and remuneration governance, and our consideration of shareholders’ rights.

Corporate Governance Structure

Structure and Composition

In 2014, the Board focused on the following:

- defining and debating strategy;

- risk appetite;

- risk management, market trends and developments, new business opportunities, and the impact of regulatory developments;

- assessing each of the Bank’s divisions and its performance against set targets that contribute to the achievement of the Bank’s overall strategy; and

- improving governance structures and processes and maintaining a governance framework that adds value to the business.

Eight Board meetings were held in 2014. The Board also had an off-site strategy meeting to debate and refine the Bank’s strategy. Senior management were invited to the Board and strategy meetings to further enhance the Board’s engagement with the management and the business. Regular tours were made to various divisions and branches of the Bank to enhance the Board’s engagement, awareness and contributions.

Strategy Setting

The Board of Directors is responsible for determining the Bank’s strategic direction. In 2014, the Board of Directors and the management team met to discuss and refine the Bank’s strategy and objectives. In order to deliver against these objectives, management has developed a detailed set of strategic plans that operate across the Bank’s businesses.

The Directors set the strategic direction of the Bank (with due consideration given to risk tolerance, shareholder expectations, business development opportunities and other macroeconomic factors), which senior management then uses to design the Bank’s annual strategic plan and prepare the annual budget for Board approval. Thereafter, senior management provides regular updates to the Board of Directors to monitor progress against budget and strategy and permit any necessary modifications or adjustments in strategic direction.

Please see further details in the Strategy section of this annual report on pages 36–37.

Board Oversight of Risk Management

Responsibility for setting our risk appetite and for the effective management of risk rests with the Board of Directors. Acting within an authority delegated by the Board, the Board Risk & Credit Committee (BRCC) has overall responsibility for oversight and review of all risk types — credit, market, operational, liquidity, fraud, reputational, etc.

The BRCC also guides management on risk appetite across sectors, geographies and customer types. It periodically reviews and monitors compliance with the Group’s overall risk appetite and makes recommendations thereon to the Board.

Its responsibilities also include reviewing the appropriateness and effectiveness of the Group’s risk management systems and controls, reviewing the outcome of stress tests and the Bank’s stress-testing methodology, overseeing the Management Risk Committees and ensuring that the Bank’s risk governance is supportive of prudent risk-taking at all levels in the Bank.

Please see further details in the Risk Management section of this annual report on page 78.

Structure and Composition

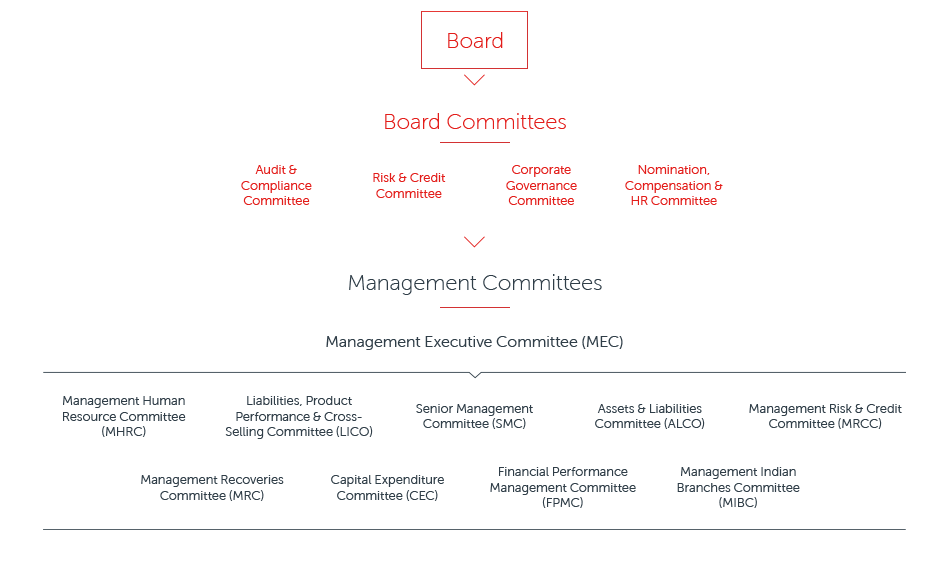

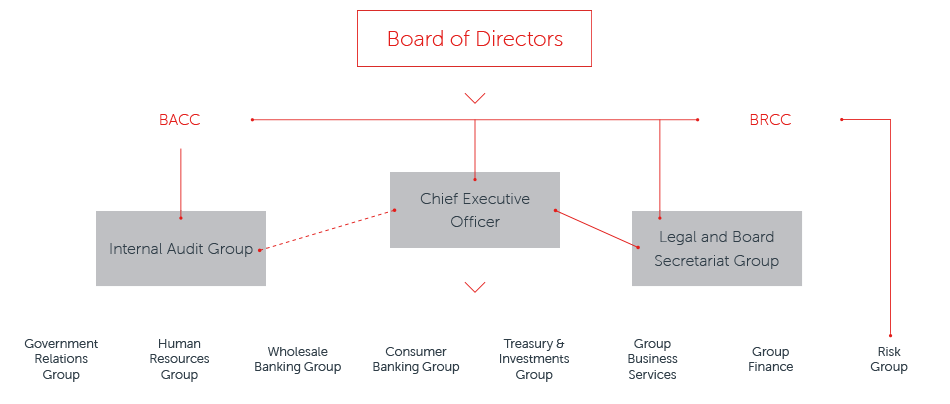

The Bank’s governance structure is headed by the Board, which has overall responsibility for guiding the Bank, including setting its strategy (including risk strategy). The Bank has a number of Board Committees and management committees which, together with their other responsibilities, oversee and monitor the day-to-day activities of the Bank. Further details about the committee structure are set out in the chart on page 63. At ADCB, we believe that good governance is fundamental to the successful achievement of our goals. Our reporting lines are also an important part of our governance structure, and they support good governance in the following way:

- The Chief Risk Officer is independent and reports to the Board Risk & Credit Committee;

- The Head of Internal Audit is independent and reports to the Board Audit & Compliance Committee; and

- The Board Secretary is independent and reports to the Board.

Board Membership and Attendance

In addition to the below, during 2014 the Board appointed several short-term ‘special committees’ with responsibility and authority to consider certain subjects. In particular, special committees were appointed to consider the future strategy of the Bank’s Indian branches and to formulate the Bank’s share buyback strategy.

| Name | Status | Expiration of current term of office |

Board | Audit & Compliance Committee |

Corporate Governance Committee |

Risk & Credit Committee |

Nomination, Compensation & HR Committee |

|||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Meetings: 8 | Meetings: 10 | Meetings: 5 | Meetings: 35 | Meetings: 6 | ||||||||

| Eissa Mohamed Al Suwaidi | Director1 | 2017 | C | 7 | C | 26 | M | 5 | ||||

| Mohamed Sultan Ghannoum Al Hameli | Director1 | 2016 | M | 7 | M | 24 | C | 6 | ||||

| Ala’a Eraiqat | Director | N/A | M | 8 | ||||||||

| Mohamed Darwish Al Khoori | Director1 | 2017 | M | 7 | C | 10 | ||||||

| Khalid Deemas Al Suwaidi | Director | 2015 | M | 7 | M | 4 | ||||||

| Mohamed Ali Al Dhaheri | Director1 | 2016 | M | 8 | C | 5 | M | 6 | ||||

| Abdulla Khalil Al Mutawa | Director | 2015 | M | 7 | M | 9 | M | 6 | ||||

| Sheikh Sultan bin Suroor Al Dhahiri | Director | 2015 | M | 5 | M | 4 | ||||||

| Omar Liaqat | Director1 | 2017 | M | 8 | M | 8 | M | 5 | ||||

| Aysha Al Hallami | Director1 | 2016 | M | 7 | M | 9 | M | 32 | ||||

| Khaled H Al Khoori | Director | 2015 | M | 7 | M | 29 | ||||||

| C Chairman M Member 1 Elected by Abu Dhabi Investment Council | ||||||||||||

Scroll to view full table

Performance Evaluations

An effective Board is crucial to the success of the Bank. To assess the performance of the Board, the Board undergoes a rigorous performance evaluation annually. The Board recognises that board evaluations are an essential component of good governance. The Bank conducts an in‑house Board evaluation every year, and in line with global standards, engages an independent external consultant to perform the evaluation every third year.

In 2012, the Bank engaged Professor Andrew Chambers, a leading governance expert, to perform an evaluation of the Board. The recommendations made by Prof. Chambers were described in the Bank’s 2013 annual report and have been implemented. An evaluation exercise was conducted in-house in late 2013 and early 2014. Details of the process employed for the Bank’s in house evaluations can be found in the Bank’s Board Performance Evaluation policy. For the first time, the Bank’s evaluation process conducted in late 2013 and 2014 included a Board Member self-evaluation process led by the Bank’s Chairman. In addition, the Board’s Adviser, Sir Gerry Grimstone, assisted with the process by meeting with various Board Members and members of management, and making various recommendations to improve Board engagement. Following conduct of the 2013/2014 evaluation, the Board Corporate Governance Committee agreed on various actions and improvements to the Bank’s governance practices that were all implemented during 2014. These actions included the following:

- Improvements to the risk-related materials presented to the Board;

- Improvements to the Board training and skill-enhancement processes;

- Enhancement to the Budget setting processes; and

- Involvement of senior management members in the Board evaluation process.

Appointment, Retirement and Re-Election

According to the Bank’s articles of association:

- All Directors are required to seek re‑election by shareholders every three years, and one-third of the Board must seek re-election on an annual basis.

- Abu Dhabi Investment Council has the right to elect such number of Directors as is proportionate to the percentage of the Bank’s share capital that it holds (as at 31 December 2014, 58.08%).

- Details of the Board Members’ current terms of office and, where relevant, their election by Abu Dhabi Investment Council, are set out in the table under ‘Board Membership and Attendance’ noted above.

Please see further details here.

The Board’s Adviser

The Bank has appointed Sir Gerry Grimstone as an independent Adviser to its Board of Directors. In 2014, Sir Gerry Grimstone attended five Board meetings, two Board Committee meetings (Nomination Compensation & HR Committee), and the Board strategy sessions. His background and lengthy experience enriches the Board’s discussions and deliberations, most particularly in strategic discussions, Board reporting and effectiveness, assessment of the performance of senior management, assessment of risk appetite and rewards.

Directors’ Independence

The Bank considers that during 2014, the Bank’s independent Directors represented more than one-third of the Board; and throughout 2014, the majority of Members of the Board Audit & Compliance Committee were independent.

Please see further details, including the Bank’s independence criteria here.

Induction and Professional Development

In 2014, no new Directors were appointed to the Board. In the event that any new Directors are appointed, they are given formal induction and orientation regarding financial matters and business operations. In addition, the management will facilitate their visits to the Bank’s departments and key branches to get familiar with the Bank’s operations. The management would also organise a series of induction meetings with key executive management members. Please see details here for additional information concerning the Bank’s induction programme for newly appointed Directors.

Matters Reserved to the Board and Information Dissemination

Please see details here.

Meetings

In 2014, the Board of Directors met regularly, and Directors received information between meetings about the activities of Board and management committees, and developments in the Bank’s business. There were eight Board meetings and 56 Board Committee meetings in 2014. The table on page 65 gives details of each Director’s attendance at meetings of the Board and Board Committees in 2014.

Board Committees

The memberships and chairmanships of the Board Committees are reviewed on a regular basis to ensure suitability and compliance with other requirements, and rotated as needed. No changes were made to the Committee Membership in 2014.

Management Committees

The management has established the following management committees:

| Committee name | # of meetings held in 2014 | Responsibilities of the committee |

|---|---|---|

| Management Executive (MEC) | 39 MEC meetings and 6 Strategic MEC meetings. |

Most senior management committee, which provides oversight of all of the Bank’s businesses and operations. |

| Senior Management (SMC) | 8 | Administration, governance, change management, strategy, and project updates and dissemination of information. Pre-screening of certain matters before MEC review. |

| Assets & Liabilities (ALCO) | 7 | To make investments and execute asset/liability transactions within delegated limits and to guide MEC and the Board on other investments and asset/liability transactions above those limits. |

| Management Risk & Credit (MRCC) | 57 (52 regular MRCCs and 5 Strategic MRCCs) |

To approve credits within delegated limits, to consider risk appetite and strategy issues, and to set and recommend risk policies; to guide the MEC, Board Risk & Credit Committee and the Board on credits above those limits and on general risk and risk policy issues. |

| Management Recoveries (MRC) | 5 | To approve recoveries within delegated limits and to guide MEC and the Board on recoveries above those limits. |

| Capital Expenditure (CEC) | 8 | To review and approve project capital expenditure within delegated limits, and accordingly guide and advise the MEC and Board on project capital expenditure. |

| Liabilities, Product Performance & Cross-Selling (LICO) | 11 | To tactically strategise the liabilities initiatives of the Bank at the Businesses/product levels with ongoing monitoring of achievements of different product groups. The Committee is also responsible for cross-selling initiatives, monitoring product performance and approving pricing and marketing of products with the theme of having a focussed approach to the market on initiating liabilities. |

| Management HR (MHRC) | 6 | To act as a forum for prior screening, discussion and recommendation of all human resources–related matters that ultimately appear before the MEC. |

| Financial Performance Management (FPMC) | 7 | To monitor financial performance of the Bank’s business lines. |

| Management Indian Branches (MIBC)* | 3 | To support the MEC in its responsibility to oversee and manage the Bank’s branches in India. *The Committee was formed in September 2014. |

Scroll to view full table

Other Practices and Policies

Conflicts of Interest

Details of all transactions in which a Director and/or other related parties might have potential interests are provided to the Board for its review and approval. Where a Director is interested, the interested Director neither participates in the discussions nor votes on such matters. The Bank’s policy is to, so far as possible, engage in transactions with related parties (including Directors) only on arm’s-length terms.

The Board Secretariat maintains a conflicts register that is regularly reviewed by the Board Corporate Governance Committee.

As at 31 December 2014, as a result of written declarations submitted by each of the Board Members, the Board was satisfied that the other commitments of the Directors do not conflict with their duties, or that, where conflicts may arise, the Board is sufficiently aware and appropriate policies are in place to minimise the risks.

Dividend Policy

The Bank has not adopted a formal dividend policy.

Internal Controls

In 2014, the Board of Directors, through the Board Audit & Compliance Committee, conducted a review of the effectiveness of the Bank’s systems of internal control covering all material controls, including financial, operational and compliance controls, and risk-management systems. The Board Audit & Compliance Committee has received confirmation from the Bank’s Internal Audit Group that the Bank’s internal controls have been assessed to be effective and operating as designed, and that management has taken or is taking the necessary action to remedy any failings or weaknesses identified.

Please see details here.

Audit Arrangements

The external auditors were initially appointed at the 2011 Annual General Meeting (AGM); at the 2012 and 2013 Annual General Assembly, PricewaterhouseCoopers (PwC) were re-appointed as the external auditors of the Bank on the recommendation of the Board of Directors. Bank policy restricts the firm’s tenure to no more than seven consecutive years. Bank policy also restricts the tenure of the individual audit partner within the firm to no more than five consecutive years, unless exceptionally approved by the Board Audit & Compliance Committee1. The Bank’s external auditor is paid on a fixed annual fee basis, as approved by the shareholders at the AGM. In 2014, fees paid to external auditors for audit work conducted during the 2014 year totalled AED 1,496,080 for the audit of the Bank’s UAE business and its subsidiaries. A further AED 815,837 was paid to PwC for non-audit work primarily related to certification work undertaken in relation to the Bank’s capital market issuances. All non-audit work performed by PwC was pre-approved by the Board’s Audit & Compliance Committee.

1. In September 2014, Abu Dhabi Accountability Authority (ADAA) established new Statutory Auditors Appointment Rules requiring that external audit services are tendered and rotated every four years.

Internal Audits, Regulation and Supervision

Please see details here.

The Bank’s Approach to Disclosure

The Bank is committed to high standards of transparency and continues to work on enhancing its disclosures annually to remain in line with local and international best practice. In this year’s annual report, we have focussed on giving readers a clearer picture of our performance, business model and strategy. In addition, we have remodelled our risk disclosures based on recommendations from the Enhanced Disclosure Task Force (EDTF) and enhanced our remuneration disclosures.

We believe that the Bank continues to be one of the most transparent institutions in the region. Relevant financial and non-financial information is communicated to shareholders, customers, regulators, employees and other stakeholders in a timely manner through this annual report, our quarterly market updates, our press releases, the Bank’s website, via Abu Dhabi Securities Market (ADX) and in various other ways. We also take internal communications extremely seriously, and staff are kept aware of all new developments, including the Bank’s strategic direction, objectives, ethics, risk policies, general policies and procedures, new regulations and other relevant information via numerous internal channels.

ADCB communicates with shareholders through this annual report, through its quarterly market updates, through press releases and by providing information at the Annual General Assembly Meeting. The Bank has an Investor Relations department whose role is to ensure strong communication with the Bank’s investors.

Diversity

During 2013, Aysha Al Hallami was appointed as a Director. Aysha Al Hallami is the first woman to be appointed to the Bank’s Board of Directors. This is in line with international trends and the Bank’s efforts to promote greater diversity at the Board level, and it also corresponds with the Government’s efforts to empower Emirati women.

The Bank’s Board is aware of the advantages of all types of diversity. A diverse Board is likely to make better decisions.

Articles of Association

The Bank’s articles of association are available on the Bank’s website.