2017 was a true test of ADCB’s ambition and discipline. The year brought challenges and headwinds, yet our underlying performance remained robust. We witnessed good growth in our year-on-year profits, which was particularly strong in the last quarter of the year.

We continued to invest in our franchise, whilst demonstrating healthy growth in loans and deposits, up 3% and 5% respectively. Our current and savings account (CASA) deposits increased significantly and comprised 43% of total customer deposits. Islamic banking delivered double-digit growth, with net Islamic financing assets up 17% and Islamic deposits up 23% year on year.

Against a backdrop of continuing economic challenges, I am pleased to see our key indicators performing well, with a strong return on average equity of 15%, robust capital adequacy ratio (Basel III) of 19.09% and a stable cost to income ratio of 33.1%.

But while the balance sheet is always an important measure of achievement, we believe success goes beyond the numbers.

For us, it means being a trusted partner to each and every one of our customers and creating long-term, sustainable value for our shareholders. It means developing and nurturing our people. It means offering an outstanding customer experience, a comprehensive and growing range of products and services, first-rate digital innovation, and, of course, secure, straightforward access to your money no matter where you are.

Competition in the market is growing — and not just from other banks. Feisty start-ups, fintech companies and even non-financial players, such as Uber, are starting to disrupt the world of finance. That is why we are driving sustainable growth through a diversified portfolio and making certain that our customers are front and centre of everything we do, so their banking experience is second to none. This is more than automating processes; it is designed to change how the bank interacts with the entire financial ecosystem.

To achieve this, we have relied on a carefully-considered strategy, a clear and compelling vision, and — perhaps most important — a strong set of shared values from our talented and committed workforce.

Values are important: they make us who we are and set us apart from our competitors. For this reason, we spent time over the past year considering, developing and creating a set of core values shared by everyone at the Bank, from the bottom to the very top.

These values are: Integrity, Care, Ambition, Respect and Discipline.

Each one influences our behaviour, plays a vital part in the decisions we make, and positively contributes to our culture and the very success of our business.

I am pleased and proud to have played a part in bringing these to life. They have already helped us to work better together, enriching our work, our culture of ambition, and our relationships with our colleagues and customers.

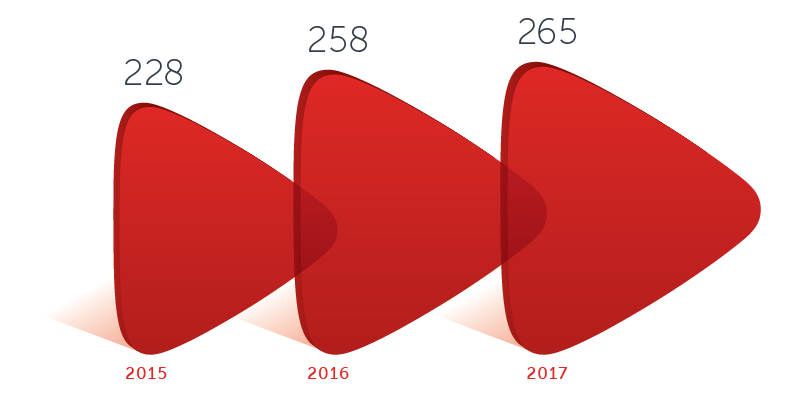

These values are now the common currency of our entire workforce — part of every staff ID card — and are used to help review, improve and reward performance. For that reason, our values are intrinsically linked to our Net Promoter Score (NPS) and form a major part of the objectives set for staff across the organisation. Launched 3 years ago, NPS measures our customers’ propensity to recommend ADCB to family and friends. NPS is a vital tool for helping us to improve the customer experience we deliver both inside our Bank and externally.

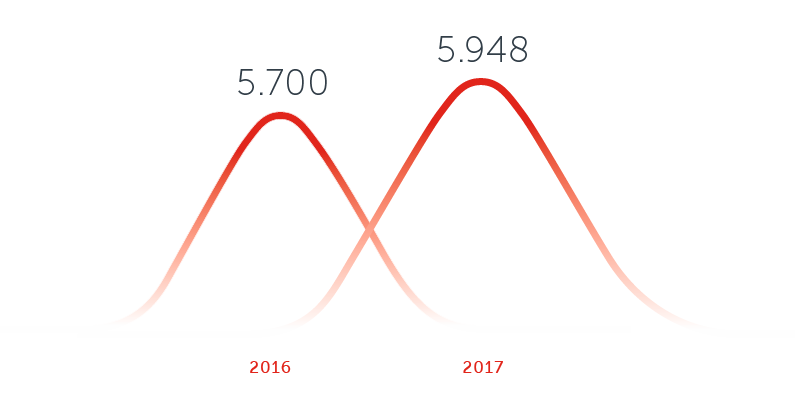

Another strong insight into our performance comes from our company-wide engagement survey. The results have shown a keen awareness of our values, with scores up by 4% year-on-year to 92% in 2017, a high level by any standard.

ADCB’s Strategy, with its focus on the UAE, continues to prove successful and has guided the Bank steadily towards its goal of being the most valuable Bank in the UAE.

Our strategy is another key contributor to our success. It has remained steady and consistent — acting as the rudder with which we have successfully navigated the headwinds of a relentlessly challenging global economy. With its five key pillars, it continues to harness our collective ambition to ensure we remain the most valuable and resilient bank in the UAE.

We retain our sharp focus on serving the UAE, generating profit and sustainable growth for all our stakeholders through effective risk management.

We are also committed to placing our customers at the heart of everything we do, creating a seamless customer journey.

Over the past year, we have done even more to ensure that the voice of the customer comes in loud and clear in every part of the organisation. Our net promoter score is measured across the entire brand and gives us immediate feedback. This helps us to develop and improve our services as well as creating an opportunity to engage with our customers on a uniquely personal level.

A best-in-class customer experience is central to our ability to grow and prosper and we are committed to a continuous improvement. I am pleased to say the system is working. Our NPS scores have improved significantly. The results have shown a positive trend across all dimensions of our service ambition. Customers are confirming that ADCB is moving in the right direction in line with our ambition, with substantial increment in NPS Points from 2014.

We were also honoured with the Mohammed Bin Rashid Al Maktoum Business Innovation Award and the Outstanding Award for Business Innovation in 2017. These awards recognise our contributions in business innovation, which have resulted in a superior customer experience.

We also want to harness digital for growth and efficiency across the bank, enhancing our systems and making greater use of data analytics to improve our services.

Digital development and innovation are also key ingredients to our success.

Following a two-year programme of planning, testing and training, we transformed and upgraded our core banking system in 2017, migrating and consolidating many complex systems into a single, fast, agile and secure platform.

We now have an unprecedented capability to deliver fast-to-market solutions and a solid foundation for the further development of customer experience enhancing solutions. This is an essential tool for the development of our digital services, anticipating the changing needs of customers in an increasingly connected world.

Indeed, to underscore this commitment, we have made digitisation one of the five key pillars in our strategic plan.

Our aim is to use cutting-edge technology that creates value for our customers by improving their experience. We also want to harness digital for growth and efficiency across the Bank, enhancing our systems and making greater use of data analytics to improve our services.

This year we have expanded our uBank network, creating even more self-service opportunities. The number of customers using mobile and internet banking also continued to rise; today 96% of all retail transactions are completed electronically. On the corporate side, we have actively migrated our clients from physical to electronic banking. In just two years, the proportion of clients serving themselves this way has risen from 38% to 80%.

As the Bank becomes ever-more digital, we must also become a more agile organisation, able to adapt quickly to changes in the market and to drive greater efficiency.

Our success also means helping others and empowering financial literacy remains a significant objective for us. It also helps to contribute to the economy and stability of the UAE overall.

Through our long-standing partnership with the Emirates Foundation, we continue to work hard to raise levels of financial awareness, especially with young adults.

In 2017, we launched our Money Sense programme designed to promote financial literacy among UAE nationals aged 18–35. During the year, we reached more than 1,000 people with information on topics such as budgeting, saving, responsible borrowing and planning for the future. This followed a successful pilot programme started in 2016.

In view of the changing economic landscape, this approach remains both valuable and increasingly relevant. That is why we have fully revamped the programme and made it available on a new digital platform which allows us to reach even more people.

We have also developed our Tamooha initiative, which provides work for Emirati women who want to work in an environment suited to their traditional values. We have widened the initiative to cover more areas of our operations and improved its performance.

We are a pioneer in responsible lending practices and I am delighted that we continue to play an important role in encouraging the adoption of sound financial management practices across the UAE.

Last year, we laid important foundations for growth. Our decision to develop a formal digital strategy, backed by significant investment, will improve our operating model and increase our agility to better serve our customers.

For all the discussion around economic headwinds, there is much to be positive about in the economy too. There are plenty of opportunities on which to capitalise in this evolving market.

We remain well-positioned to benefit from the long-term growth prospects of the UAE economy and a well-articulated and well-executed strategy that has been tested relentlessly over the past nine years. Our deeply experienced and stable management team have provided outstanding leadership that continues to yield strong results.

To stay ahead, we must remain an agile organisation, open to positive challenges, new ways of working and ground-breaking ideas. Our values will help create this change and our strategy will enable it to flourish.

So, I invite you to celebrate the achievements we have all made together and to continue on this exciting and rewarding journey with us.